- The Drop

- Posts

- 🍩 Consoomer crypto

🍩 Consoomer crypto

Who's got the 'brand' to launch a stablecoin?

It’s scorching out, and summer’s in full swing.

…Are stablecoins?

In today’s feature, a takeover from Katherine from the Empire newsletter, Core VC partner David Roos predicts who the big winners will be, as companies race to bring stablecoins into the mainstream.

Plus, Blockworks Research has a super-useful new dashboard to look at all these crypto treasury companies popping up.

🤞 Steady now

Core VC’s David Roos is still pretty excited about all of the attention stablecoins are getting.

And he’s clearly not alone, based on Bitwise data.

Stablecoins are going parabolic.

— Bitwise (@BitwiseInvest)

4:35 PM • Jul 28, 2025

“You're seeing that this is an innovation that really has legs,” Roos added. Conduit, a stablecoin infrastructure firm, is one of Core’s portfolio companies.

I asked him if he thought that everyone and their mother would launch stablecoins post-GENIUS, because we’ve already heard from a slew of interested firms, including Interactive Brokers.

“It's not going to be like thousands of stablecoins out there, but I do think there will be — call it a dozen — and it'll be led by massive organizations that have the power to do so,” he said. Not every company has the brand power to launch its own stablecoin, he added.

He doesn’t think we’ll see something like Zelle but for stablecoins, “in terms of banks just kind of taking over the one use case.”

“I think we've seen, between Walmart and Amazon, you know, some Fortune 500’s that are looking at the ability to create this kind of closed-loop financial payment system in a way they weren't able to do previously, and it gives them a lot of benefits to bypass the system and save a lot of dollars that they're spending in interchange,” he continued.

This, Roos noted, makes a great case for digital wallets as well, which makes projects building wallets compelling.

“I think there still is a lack of consumer-friendly user interfaces in the crypto world…There is consumer education that's typically needed in order to use digital wallets, and so I'm still in search of digital wallet unit interfaces that have usability and have friendly interfaces for the non-crypto-native users, because at the end of the day, the mass market will struggle to use what is currently the infrastructure that we built out today,” he said.

But he’s also interested in digital identity because, “as more and more companies [benefit from] your data, you want to be able to control what is in your wallet, and there needs to be more security around the identity of your wallet. And so I think there will be a platform that exists and a protocol that exists that creates this consumer-centric identity,” Roos added.

And there’s your food for thought today.

Crypto has no shortage of short-term hype cycles. The best protocols buck the trends and build sustainable ecosystems for the long haul.

Join Blockworks Research, MegaETH, Flipside Crypto, and Avalanche for this upcoming Roundtable. Tune in live to ask the speakers a question!

📅 July 31 | 12 pm EST

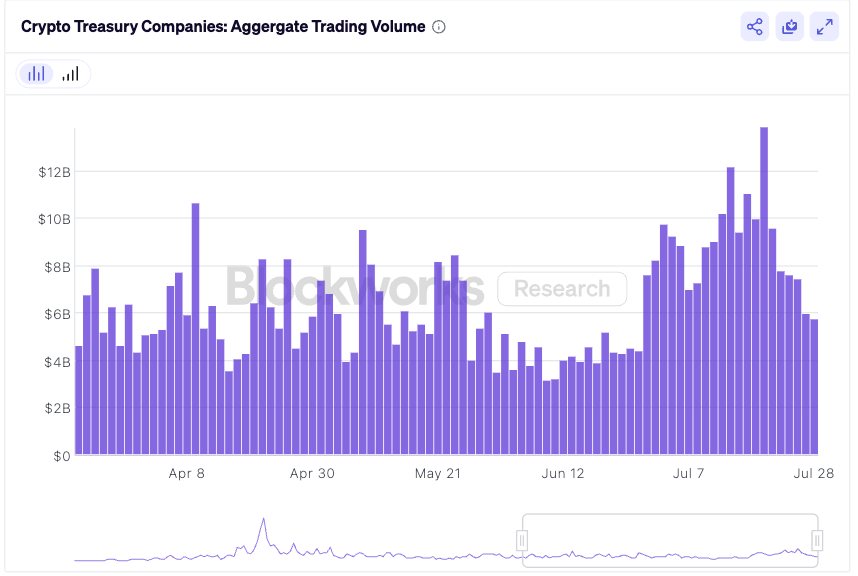

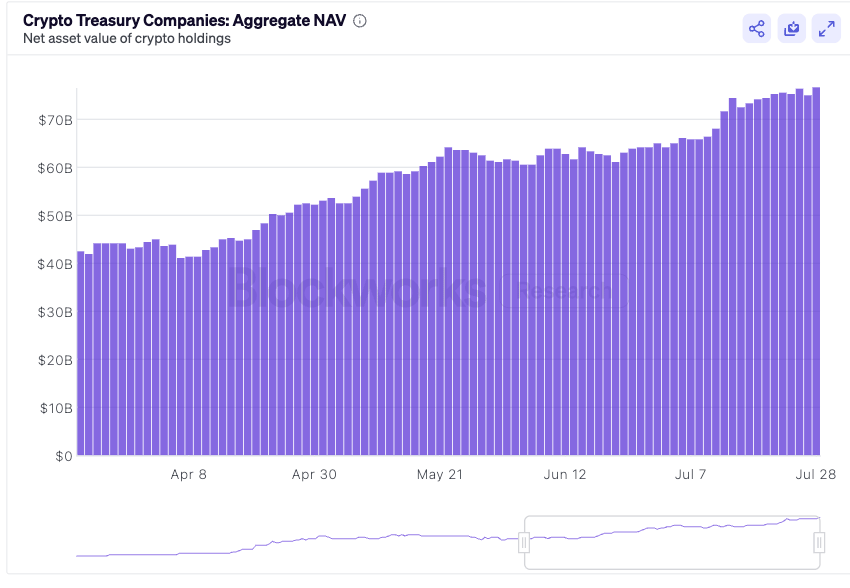

I have some good news for those of you looking for data on all of these treasury companies, or those who just want to find a better way to track said companies.

Source: Blockworks Research

This new dashboard from Blockworks Research showcases the companies, their net asset value, how much crypto they’ve accrued, and, of course, the daily trading volume.

Pretty wild to see how the trading volume and aggregate NAV continue to climb.

But I’m curious to gauge how long this can continue until folks get tired of all of these vehicles.

Via substack: