- The Drop

- Posts

- Going limitless

Going limitless

Coinbase needs prediction markets

Too little, too late: As part of a years-long class-action lawsuit, a federal judge in California has ruled that Bored Ape NFTs aren’t securities.

That’s certainly good news, though one ruling doesn’t automatically extend to all NFTs and won’t send the NFT space back to the frothy bubble it once was.

0xResearch returns to its analyst roots. Daily alpha and insights now coming directly from our research team. Investment research, market commentary, and unfiltered data-driven takes in your inbox.

In America, it’s Robinhood vs Coinbase

This year, Robinhood has been winning the consumer finance race — if its stock price is any indication.

Robinhood stock is up over 273% YTD, giving it a current market cap of $131 billion and a new all-time high.

COIN, by comparison, is up 50% YTD, with a market cap of roughly $99.8 billion.

The past five years can also help put this growth into context: HOOD is up over 318%, while COIN is up just 13%.

Ex-Coinbase 1confirmation founder Nick Tomaino suggests that prediction markets will be the thing that could take Coinbase to the next level, and get it closer to Robinhood-level gains.

Robinhood ($133B market cap) is beating Coinbase ($97B market cap) as the everything app for investing

The battle is far from over though

Prediction markets are the key

— Nick Tomaino (@NTmoney)

4:09 PM • Oct 3, 2025

I’m inclined to agree that it’d be the best way to drive revenue in the current market.

Adding smaller features like sending USDC to anyone using just a phone number is certainly useful. But this approach is unlikely to move the needle for Coinbase, which now competes with the likes of PayPal and Venmo for crypto users as well.

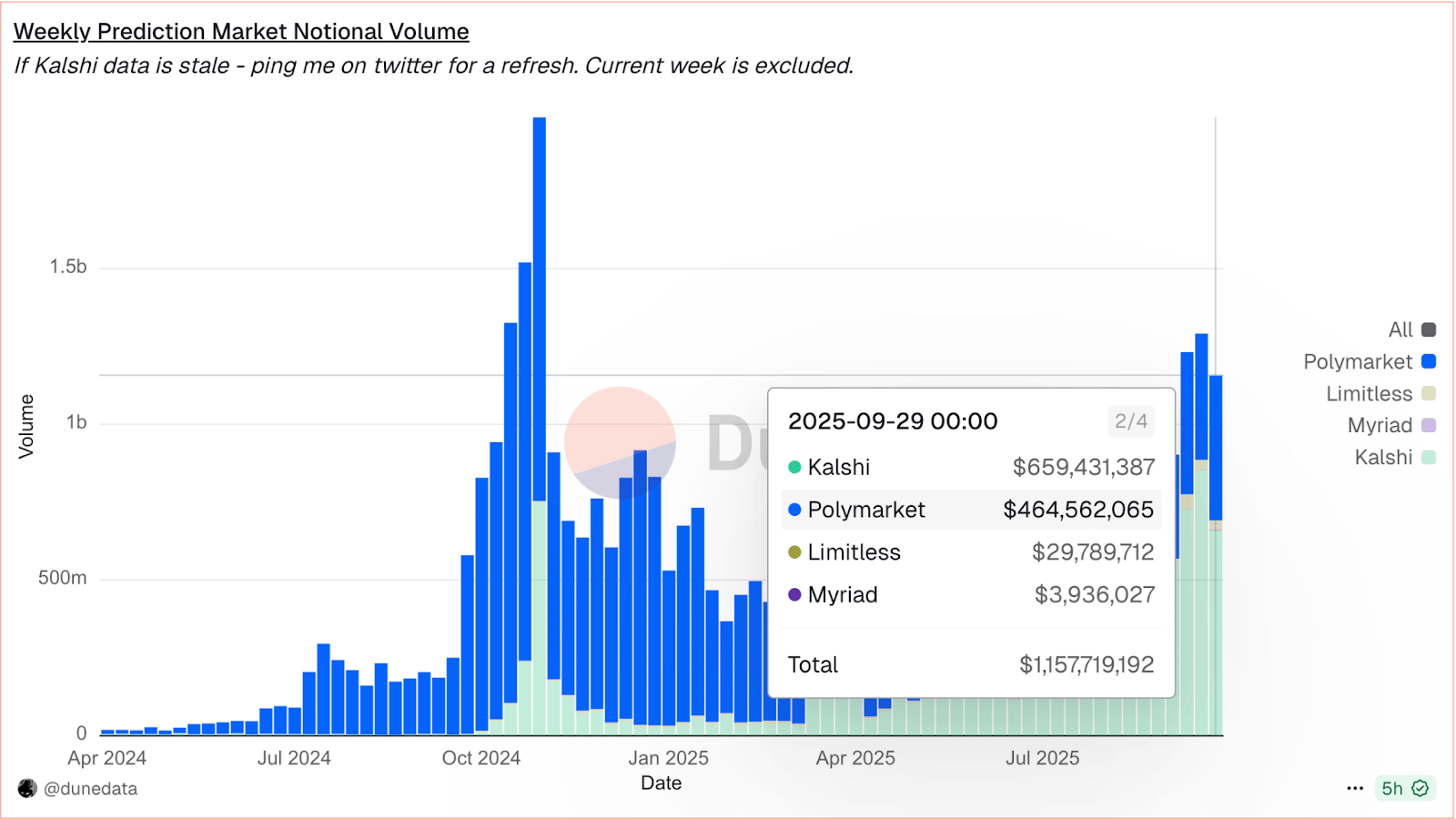

Last week, we looked at how prediction markets are surging again and Kalshi has flipped Polymarket. Kalshi saw over $260 million in volume on Sept 27 alone, with roughly $3 billion in monthly volume in September.

Much of Kalshi’s activity, however, is coming from its deal with Robinhood. One Piper Sandler analyst said that 25-35% of all Kalshi activity occurs on Robinhood, which has now seen its prediction markets integration become a $200 million value-add.

For what it’s worth, Robinhood CEO Vlad Tenev remains very bullish on prediction markets.

“We’re already seeing prediction markets disrupt sportsbooks, reshape how news is reported/consumed, and give traders a native tool to price expectations. The shift is underway,” Tenev wrote on Friday.

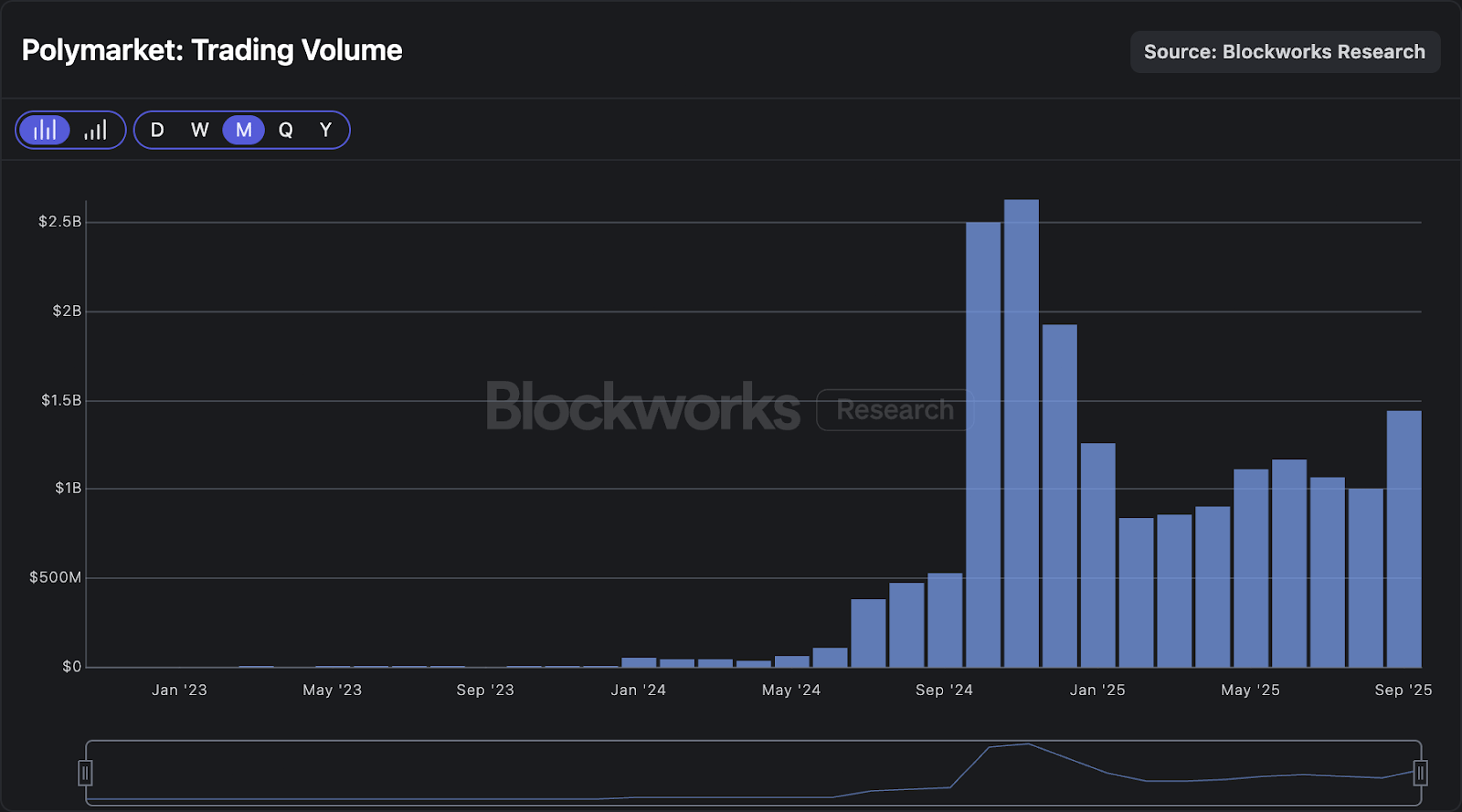

Polymarket, which is built on Polygon, also continues to see substantial volume, with over $1.3 billion in volume traded in September alone.

Coinbase is obviously missing out — and leaving money on the table.

Limitless, which uses Base, would be the obvious integration if Coinbase didn’t want to build out its own markets feature.

(Notably, Tomaino’s 1confirmation led Limitless’s $3 million seed round last year.)

But Limitless remains much smaller than its rivals. In the last week of September, Kalshi saw far more weekly volume than Limitless:

Could Coinbase launch its own prediction markets to stay competitive, and tap into the multibillion-dollar prediction market economy? Or, at the very least, integrate Limitless like the way Robinhood uses Kalshi?

“I think prediction markets are very exciting, and I actually would love to see prediction markets come more on-chain,” Brian Armstrong said earlier this year during COIN’s Q2 earnings Q&A.

For Coinbase, expanding to prediction markets is certainly possible, given its status as a multibillion-dollar financial firm with the capacity to ship fast and US political donations that have surely improved its standing in the Trump White House.

Watching Robinhood and Coinbase battle for volume during the Super Bowl would certainly be worth the watch.

Crypto is changing TradFi derivatives as we know them.

DAS: London will feature all the builders driving this change.

Get your ticket today with promo code: DROP100 for £100 off.

📅 October 13-15 | London

$30M in tokens

Joe Lubin has shared more details about the MetaMask token — and says you should start using your wallet again if you want a piece of the pie.

“Long-time users will see meaningful benefits, not only through Season 1 of Rewards but also through the upcoming MetaMask TGE,” Lubin wrote Sunday night. “If you haven’t transacted with MetaMask in a while, now’s the time.”

The first rewards season is valued at $30 million, some of which will be in the LINEA token.

“We’re designing an experience that rewards people for how they already use MetaMask through meaningful incentives, perks, and referrals,” Lubin said.

Of course, crypto loves free money — and crypto companies love printing it. Multimillion-dollar airdrops don’t always foster a loyal user base, though. Free tokens aren’t a long-term strategy because they create sell pressure and generate a whole lot of marketing and hype that doesn’t necessarily translate into long-term revenue.

After an airdrop, a product that’s better than your competitors’ is essential.

But MetaMask says their rewards scheme is “not a farming play” and will be more structured, with “yield referral rewards, mUSD incentives, exclusive partner rewards,” tokens, and other perks, which sounds more sustainable for long-term incentives than a simple airdrop.

We’ll see whether Consensys plans to incentivize holding or buying the MetaMask token, or whether it will be little more than an expensive tool to try to keep traders off Coinbase and Phantom.

OpenSea continues pivot away from just NFTs:

opensea just had a $100M volume day, and 85% of it was token trading

those are still small numbers relative to the broader market, but this is just the beginning for us.

in crypto, there are many ways to be successful:

one is to be the first. this was opensea's early playbook

— dfinzer.eth | opensea (@dfinzer)

8:59 PM • Oct 3, 2025

1. Where do you work? |

2. What's your level of crypto knowledge? |

3. What are you interested in? |