- The Drop

- Posts

- 🌏 Traveling onchain

🌏 Traveling onchain

Amex spins up NFTs, wallets

Brought to you by:

Web2 giants have toyed with NFTs many times before. Some pushes have been more meaningful than others.

Starbucks’ Odyssey digital collectible play with themed, limited-time loyalty “stamps” was largely a gimmick that ultimately flopped. Nike sold overpriced RTFKT 3D avatars and digital sneakers for years before throwing in the towel on NFTs, too.

Reddit, however, did NFTs right. Users wanted certain characters to represent them across the app they already cherished and used daily. There was immediate, obvious value and utility — no “wait and see” promises or mercurial roadmaps.

All that said, we’ve seen Web2 giants’ NFT plays rake in the cash regardless of whether they ultimately sink or swim. Starbucks made over $1.3 million with its little Polygon NFT experiment, and Nike made over $185 million across numerous RTFKT drops that just kept coming.

NFTs as a technology can still be profitable and appealing to consumer audiences, even if they aren’t so trendy anymore.

It just depends on how they’re marketed, and what purpose they serve.

Now, we’re seeing a TradFi firm dip a toe in the NFT waters. The latest is none other than American Express, which wants you to see it as a travel-friendly card brand (even if many merchants globally won’t accept it because of its higher merchant fees).

Let’s take a look at what it’s up to — I’m curious to see whether Amex ultimately decides its latest crypto push was worth the extra investment.

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

Amex does Starbucks one better

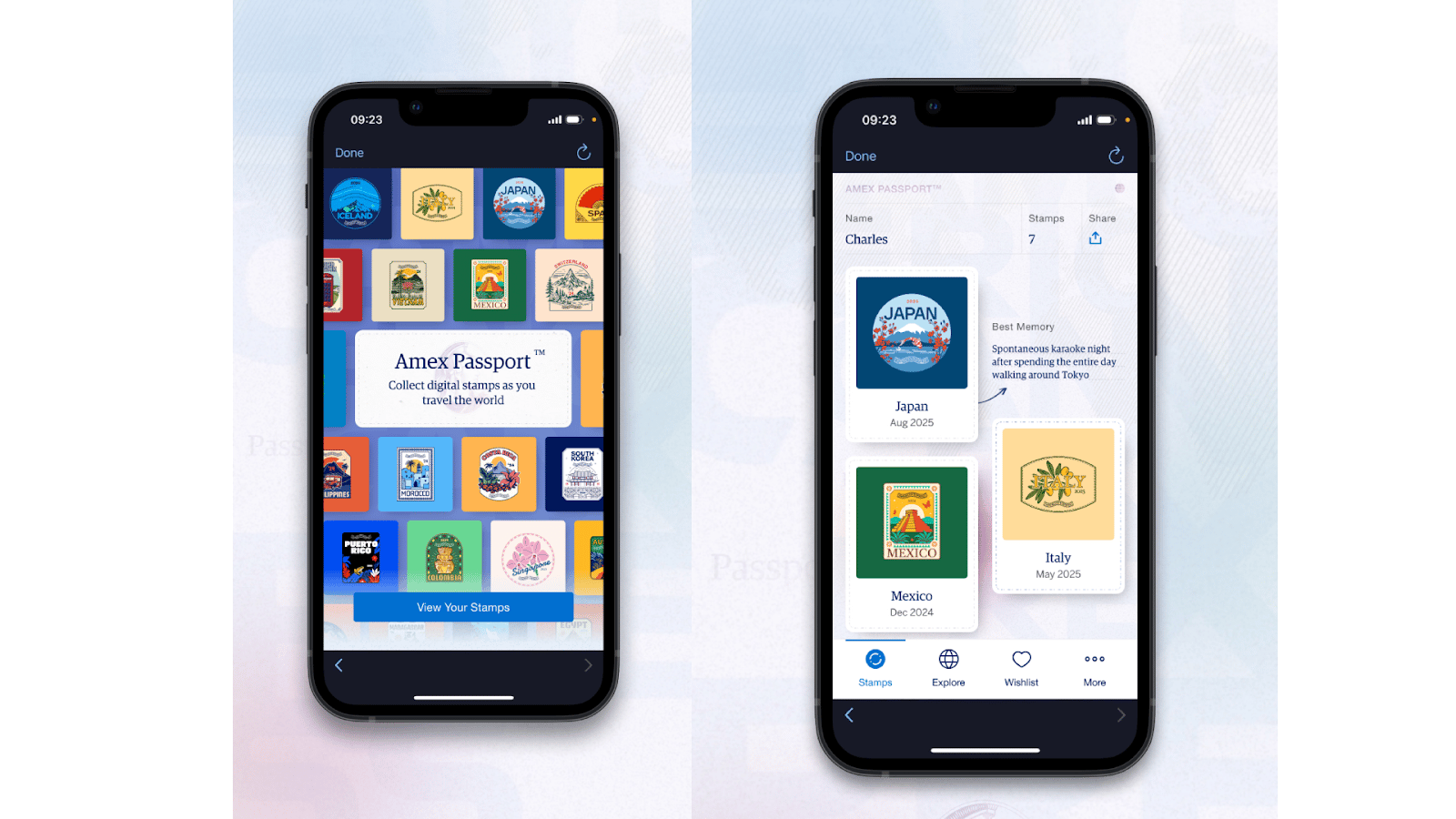

Miss collecting stamps in your passport? American Express is now giving US cardholders onchain travel “stamps” for each country visited around the world.

Each digital “stamp” within the Amex Passport feature has an associated piece of art that will be an ERC-721 token on Base, Colin Marlowe, VP of emerging partnerships at Amex Digital Labs, explained to me in an interview.

Obviously, it’s not a real passport though, so don’t bother showing the customs officer your app full of NFTs when you’re jetting off to a new locale.

Stamps are viewable within the existing Amex mobile app, which is separate from the upcoming Amex Travel app that’s launching Sept. 18.

Amex is backdating stamps to get cardholders started with their collections, and will add stamps from the countries users have visited in the past two years to start.

A crypto wallet for each Amex mobile app user, custodied and operated by Amex, is spun up on the backend when users access the feature. Stamps are minted as tokens behind-the-scenes as cardholders use their Amex cards at different locations around the world.

“We’re trying to do it in such a way that that’s not so in someone's face,” Marlowe said of Amex’s approach to blockchain integrations.

But cardholders won’t see the wallet that’s spun up (that’s abstracted away), won’t be directly engaging with the blockchain at all, and won’t be able to trade stamps.

The stamps aren’t introducing cardholders to crypto, per se. They’re supposed to be a way to feel just a little bit more fulfilled about global travel in an increasingly digital age.

Amex chose to put the stamps onchain as NFTs because blockchain assets can give a greater sense of permanence, Marlowe explained, like the ink of a physical stamp.

“We really are hoping again to capture a customer at the end of their journey, when they’re commemorating and thinking about where they’ve gone, in the hopes that they get inspired again and do something new with us next time,” he said.

It’s not surprising that Amex is minting the travel stamps on Base. In June, Coinbase revealed the Coinbase One card, which uses Amex and promises 2-4% back in bitcoin rewards on every purchase made.

As I’ve said before, both Coinbase and Amex are positioning themselves as premium brands — though that means using them comes with higher fees compared to other options on the market.

The Amex Passport feature is now available for US cardholders within the Amex mobile app, and can be accessed by going to Account > Settings > Try New Features.

The convergence of AI, crypto, and capital is turning IP into the next real-world asset class, and the race to unlock it has already begun.

Join Story and Blockworks at Origin Summit, where this new market takes shape.

Use promo code: BWNL50 for 50% off your ticket.